With the burden of debt weighing heavily on a lot of Australians, many are turning to the notion of “Can I use my super to pay off debt?”

Using super to pay off debt or mortgage arrears is typically not permitted. However, a financial adviser can help determine if extenuating factors are at play or whether alternative strategies are worth exploring.

In this article, we will look at the complexities of using super to pay off debt and how you can work with a financial adviser to determine the most effective course of action in navigating retirement planning while adhering to superannuation regulations.

Why You Generally Can’t Use Super for Debt

Superannuation is typically not used for debt repayment due to strict regulations limiting early access to funds. Using super funds for debt repayment goes against the core purpose of a super fund, which is providing long-term financial health, and can lead to compromising your retirement funds.

Super’s Core Purpose

The core purpose of superannuation is to provide financial security in retirement for all workers by maximising superannuation returns over time through employer contributions, investment earnings, and compound interest. It is not designed for short-term needs.

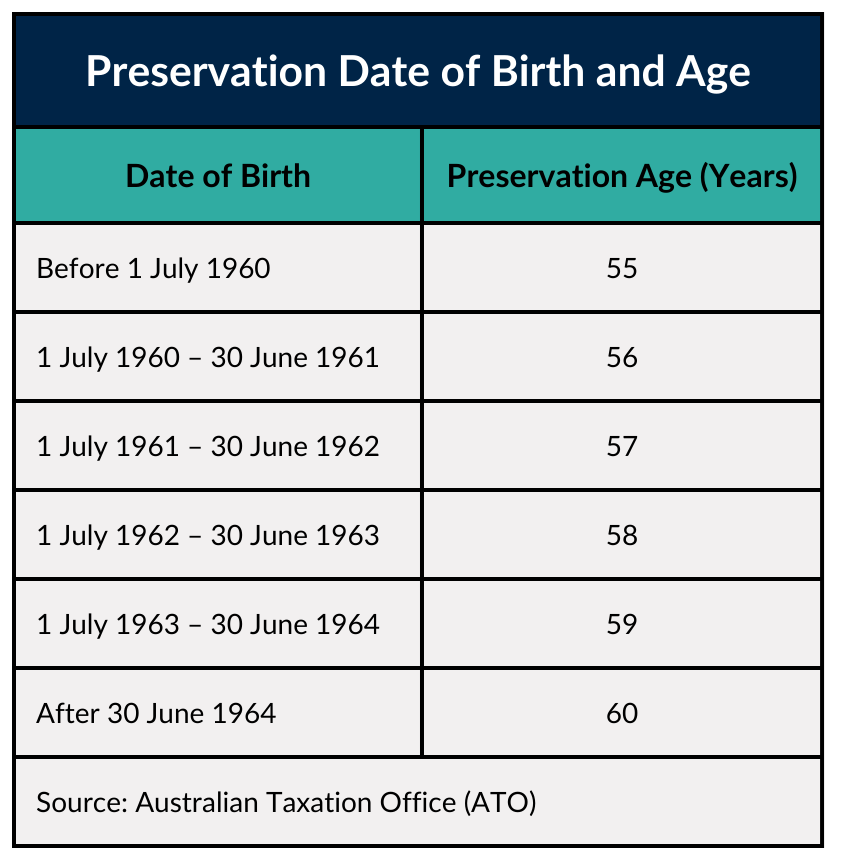

The preservation rules of superannuation dictate that certain superannuation benefits must be maintained in the super account until individuals reach their preservation age i.e. the earliest age at which individuals can access their super benefits.

Negative Consequences

Early withdrawal from your super fund can negatively impact long-term financial security and retirement savings.

You miss out on the compounding growth that these funds would have achieved over time, reducing your overall retirement nest egg, leading to a lower income during retirement, and affecting your quality of life and financial independence in old age.

You may incur tax liabilities when you access your super early to pay off debt, potentially reducing the net amount available for debt repayment.

Exceptions Where Super MAY Be Accessed (with Caution)

The Australian Tax Office (ATO) outlines specific criteria and strict eligibility requirements for the early release of superannuation funds in genuine cases of financial hardship or compassionate grounds. But not all super funds allow withdrawing super early for these exemptions.

Severe Financial Hardship

Can you use your super to pay off debt if you’re struggling financially?

You may be able to withdraw super funds if you’re struggling financially, although it may not necessarily be enough to pay your outstanding debt.

Accessing super due to severe financial hardship grounds requires:

- getting in touch with your super provider,

- providing documentation and evidence of financial hardship, and

- following the super provider’s procedures.

The ATO has set the following guidelines for you to understand the conditions and implications of withdrawing superannuation early.

1. Taxes Due: Early super withdrawal lump sums are taxable income, with rates ranging from 17% to 22% for individuals under 60 years old.

Lump sums are tax-free for those over 60 unless the lump sum includes an untaxed element.

2. If you’re under your preservation age plus 39 weeks you must have received eligible government income support for 26 weeks and cannot afford basic family living expenses.

The withdrawal limit is $1,000, with a maximum amount of $10,000. If your super balance is under $1,000, you may withdraw the rest after taxes. NB: You can only make one withdrawal in any 12-month period.

3. If you’ve reached the preservation age plus 39 weeks, you must have received eligible government income support for 39 weeks after reaching the preservation age and were unemployed when you applied. You may make unlimited super withdrawals if you meet these requirements.

Compassionate Grounds

You may withdraw your super early on compassionate grounds to pay for:

- your or a dependant’s medical treatment

- your or a dependant’s medical transport

- home or vehicle modifications to accommodate a severe disability experienced by you or a dependant

- your or a dependant’s palliative care for a terminal medical condition

- your dependant’s death, funeral or burial expenses

- preventing the forced sale of your home or foreclosure

Early super release on compassionate grounds is only approved by the ATO if you meet all five conditions:

Condition 1: You must be a citizen or permanent resident of Australia or New Zealand to apply.

Condition 2: You qualify for the specific compassionate ground you’re applying for.

Condition 3: You or your dependants’ expenses are unpaid or have been paid using borrowed money that is still outstanding.

Condition 4: You cannot cover expenses without accessing your super.

Condition 5: When applying, you provide all necessary supporting evidence and invoices or quotes, including documentary proof of your dependant relationship.

SMSF: Can I Use My Super to Pay Off Debt?

Early Self-Managed Superannuation Fund (SMSF) access due to severe financial hardship is also subject to eligibility criteria and regulations. SMSF trustees must evaluate early super-release applications using the same severe financial hardship criteria as retail and industry super funds.

As for early access to SMSF on compassionate grounds, you need ATO approval.

If you are an SMSF trustee and you illegally release benefits to a member who has not met a condition of release, you may be liable for administrative penalties. You may also be disqualified as an SMSF trustee.

First Home Super Saver Scheme

The First Home Super Saver Scheme (FHSSS) is a government initiative that aims to help Australians save for their first home by leveraging their super fund.

The scheme is limited to first-home deposits and does not cover existing debts.

Early fund withdrawal for the FHSSS may reduce retirement savings, impact compound interest growth, and potentially lead to tax liabilities, affecting financial security in old age.

Although SMSFs are not directly linked to the FHSSS, individuals may still participate by making voluntary contributions and withdrawing money for a first home deposit.

Before using the FHSSS, individuals should consult a financial planner to assess their finances, consider all options, and decide if utilising their super fund is best for their financial situation.

Alternatives to Using Super for Debt Repayment

Here are some practical alternatives to managing debt effectively without jeopardising your retirement savings:

- Contact creditors to negotiate lower interest rates or payment terms. If this includes a mortgage, you may also be able to transfer from a P&I loan to an interest-only loan.

- Consider transferring credit card balances to lower-interest cards, such as those with promotional 0% interest periods.

- Consider consolidating multiple debts into a single loan to simplify repayments and potentially lower interest rates.

- Consider an informal agreement with creditors to modify debt terms, such as pausing interest or reducing debt amounts.

- Explore debt management plans that negotiate interest rates or payment schedule changes with creditors.

- Consider negotiating with creditors to settle debts for less than the full amount owed.

Get Superwise About Your Superannuation with Newcastle Financial Planning Group

The core purpose of a superannuation fund is to ensure long-term financial security in retirement, making it unsuitable for short-term debt repayment. Accessing super early can have negative consequences, such as reducing retirement savings and paying tax liabilities.

At Newcastle Financial Planning Group, we can find a solution that balances both your short-term debt relief and long-term financial well-being. Check out some of our client success stories here!

We provide the specialist superannuation advice, expert knowledge and guidance you need to help you make the right financial decisions.

Call us or book online to secure your first appointment with us today and get started!

References:

- https://www.abs.gov.au/media-centre/media-releases/average-household-debt-grows-73-cent

- https://www.ato.gov.au/individuals-and-families/jobs-and-employment-types/working-as-an-employee/leaving-the-workforce/accessing-your-super-to-retire

- https://www.ato.gov.au/

- https://www.servicesaustralia.gov.au/how-to-apply-to-release-your-superannuation-early?context=21971#underseverefinhardship

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/access-on-compassionate-grounds

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/access-on-compassionate-grounds/access-on-compassionate-grounds-what-you-need-to-know#ato-Accessingsupertorepayborrowedamountsforeligibleexpenses

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/illegal-early-access-to-super

Related Articles

Withdrawing Your Superannuation Early: Is it Recommended?

Secure Your Today, Shape Your Tomorrow: Premium Financial Advice You Can Trust